Are rising wages really bad news?

There’s no shortage of news these days that will make your blood boil. But what really got me going was an article in USA Today about the next big threat to the economy: rising wages.

I am no economist, but I’ve been reading business and economic news and analyzing the future of whole industries for decades. I take a common-sense approach to economics, which any economist will tell you is a big mistake.

What USA Today said

Reporter Paul Davidson wrote an article titled “It’s great that you got a raise, but it just might hurt the stock market and the economy.”

This headline itself lays bare the challenge here. I know enough about economics to know that there are two groups fighting for a share of profits: labor and capital. When people get raises, labor is getting a larger share. When the stock value goes up, that means we’re rewarding capital.

And once you struggle though all the pop-up ads and anecdotes in the article, you actually get to a few facts that reflect the reporter’s point of view on labor vs. capital. Some excerpts:

The strong U.S. economy and 3.6% unemployment rate – a 50-year low – have spurred worker shortages that finally have triggered faster wage growth. Americans are spending those bigger paychecks, further bolstering the economy, or socking away some of the cash for retirement.

Yet pay increases are accelerating just as business revenue growth is slowing. As a result, they’re starting to narrow corporate profit margins, posing a threat to earnings and stocks, and to business hiring and investment plans. The trend eventually could temper economic growth, trigger layoffs and even contribute to the next recession, analysts say, depending on how sharply average wages rise.

So far, the effects have been modest. But economists are debating whether they’re likely to intensify in coming quarters or stabilize and strike a healthy balance between the share of national income that goes to companies and workers. . . .

Lately, employees have enjoyed more leverage. In March, there were 1.2 million more job openings than unemployed Americans, Labor Department figures show. Employers have been bidding up to attract workers, with annual wage increases topping 3% since August 2018. . . .

Eight percent of small businesses surveyed by the National Federation of Independent Business in April cited labor costs as their biggest problem, down just slightly from a record high 10% in February. . . .

Revenue for Standard & Poor’s 500 companies increased 5.3% in the first quarter compared with a year earlier, the smallest gain since the second quarter of 2017, according to FactSet figures from the 98% of firms reporting results. Among the culprits: A strong dollar that hurt U.S. exports and a slowdown in tech product sales, says Jason Ware, chief investment officer at Albion Financial Group.

At the same time, S&P 500 earnings fell 0.4%, the first decline since early 2016. As a result, net profit margins for the companies fell from 11.3% in the fourth quarter to 11.1% in the first three months of 2019, the weakest showing since late 2017, according to FactSet. . . .

And earlier this year, 53.6% of industries experienced above-trend wage growth, up from 46.9% a year earlier and an average 42% during the 10-year-old economic expansion, Morgan Stanley said in a report. Service-oriented, labor-intensive industries are most at risk of getting squeezed by rising wages, including retail, hotels and restaurants, personal care, security, education and human resources, the research firm said. . . .

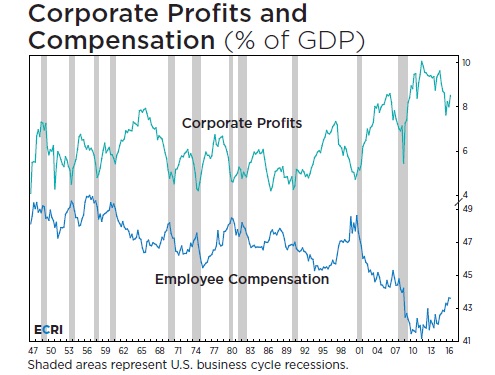

Some analysts believe rising wages can coexist with healthy profit margins. Ware of Albion notes that while profit margins fell last quarter they’ve remained historically high at double-digit levels since 2013. That’s because workers’ share of gross domestic product has fallen from nearly 58% in 2000 to about 52% recently, according to Oxford. Bridgewater Associates, an investment firm, largely blames the decline of unions, globalization, automation and weaker antitrust enforcement that has increased the market power of large companies.

A few good questions

Why is the stock market up? Because corporate profits are up. Why are profits up? Because not only is the economy in reasonably good shape, but businesses got a trillion-dollar tax cut. And what did they spend the tax cut on? Over $500 billion of stock buybacks.

Stock buybacks are great for the market. They reward capital, not labor.

Look at the statistics at the end of my excerpts above. Workers’ share of revenues has fallen. Donald Trump harnessed people’s anger about stagnating wages to become president. Now that the economy is humming, there are fewer workers available and more demand for their services. So, naturally, wages are going up.

Increased wages increase consumer buying power, which helps the economy.

They also increase inflation, which has so far been below the Fed’s target for a health economy.

If wages go up, profits will go down. The article quotes Morgan Stanley on the prospect of an “earnings recession,” which is “two straight quarters of falling profits.”

A recession is a shrinking economy. A couple of quarters of falling profits are not a recession. Corporate profits are not the only source of economic activity.

In a situation like this, companies will have to raise prices. And workers will generally benefit.

Why is this a problem?

Do we really want an economy that benefits investors far more than workers?

Let me explain this from a personal perspective. I am near retirement. Most of my net worth is tied up in my investments and my house.

If the stock market goes down, I will lose money on paper. I will have less to retire on — in the short run.

But in the long run, an economy that rewards workers more is far healthier for America. I’d rather benefit 125 million workers than a far smaller number of investors. I would like to have a healthy country to retire in. And a healthy country is likely to have a more highly valued stock market in the long run.

Looking at it from the reverse angle, an economy that benefits investors far more than workers is going to be full of unhappy people, which is going to lead to a lot more upheaval. That upheaval will crash the economy, and eventually the market, too.

So let the wages increase. It’s about time the working man got a larger share of the pie.