The loopholes in Trump lawyers’ tax letter about financial ties in Russia

Lawyers may be verbose, but they’re precise; what they write is supposed to be unambiguous. When reading a document from a lawyer, the ambiguity typically comes, not from what’s written, but from what’s left out. For example, let’s take a look at the letter that President Trump’s lawyers wrote suggesting that he’s got no financial ties to Russia worth worrying about.

Lawyers may be verbose, but they’re precise; what they write is supposed to be unambiguous. When reading a document from a lawyer, the ambiguity typically comes, not from what’s written, but from what’s left out. For example, let’s take a look at the letter that President Trump’s lawyers wrote suggesting that he’s got no financial ties to Russia worth worrying about.

Claims about Russia and Trump refuse to die, from the FBI’s investigation of whether the Trump campaign colluded with Russia, to last night’s question of whether he inappropriately revealed classified information in an Oval Office meeting with the Russian ambassador.

Trump has attempted to put the financial elements of these speculations to rest with a letter from his tax lawyers. Like any legal document, it’s precise, and it’s actually clearer than most. But let’s take a look at what it doesn’t say as well. Translation is mine. I’ve bolded words that leave loopholes open.

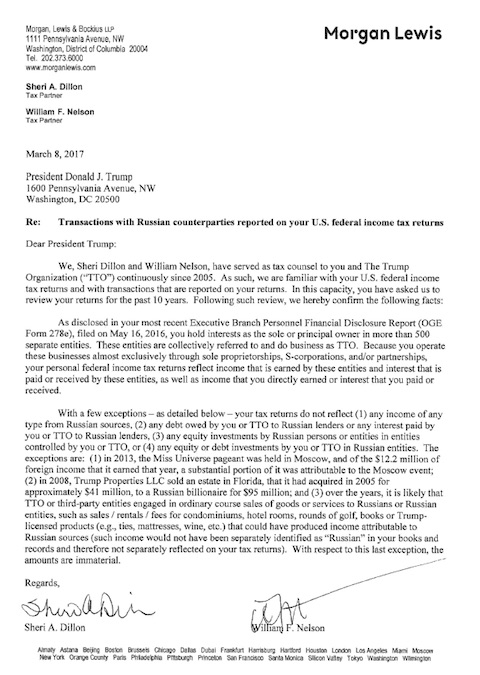

Sheri A. Dillon Tax Partner

William F. Nelson Tax Partner

March 8, 2017

President Donald T. Trump

1600 Pennsylvania Avenue

NW Washington, DC 20.500

Re: Transactions with Russian counterparties reported on your U.S. federal income tax returns

Dear President Trump:

We, Sheri Dillon and William Nelson, have served as tax counsel to you and The Trump Organization (“TTO”) continuously since 2005. As such, we are familiar with your U.S. federal income tax returns and with transactions that are reported on your returns. In this capacity, you have asked us to review your returns for the past 10 years. Following such review, we hereby confirm the following facts:

Translation: We reviewed your tax returns, which we’ve helped with in the past. The statements here reflect what we found in our review. We’re not saying how we conducted this review or how thorough it is. And we’re not talking about transactions that are not reported on the returns.

As disclosed in your most recent Executive Branch Personnel Financial Disclosure Report (OGE Form 278e), filed on May 16, 2016, you hold interests as the sole or principal owner in more than 500 separate entities. These entities are collectively referred to and do business as TTO. Because you operate these businesses almost exclusively through sole proprietorships, S-corporations, and/or partnerships, your personal federal income tax returns reflect income that is earned by these entities and interest that is paid or received by these entities, as well as income that you directly earned or interest that you paid or received.

Translation: What you are about to read reflects only income derived from partnerships and similar entities. It does not reflect any benefits that do not generate income, such as increases in the capital value of assets.

With a few exceptions — as detailed below — your tax returns do not reflect (1) any income of any type from Russian sources, (2) any debt owed by you or TTO to Russian lenders or any interest paid by you or TTO to Russian lenders, (3) any equity investments by Russian persons or entities in entities controlled by you or TTO, or (4) any equity or debt investments by you or TTO in Russian entities.

Translation: This speaks only to what’s on the tax returns. This does not reflect gains that are not reported as income, sources of income that are not taxed, or sources of income that have been concealed. As Josh Marshall points out in TPM, it’s typical for The Trump Organization to allow its brand to be used on all sorts of real estate projects that eventually generate value, but wouldn’t be reflected on a tax return.

The exceptions are: (1) in 2013, the Miss Universe pageant was held in Moscow, and of the $12.2 million of foreign income that it earned that year, a substantial portion of it was attributable to the Moscow event; (2) in 2008, Trump Properties LLC sold an estate in Florida, that it had acquired in 2005 for approximately $41 million, to a Russian billionaire for $95 million; and (3) over the years, it is likely that TTO or third-party entities engaged in ordinary course sales of goods or services to Russians or Russian entities, such as sales / rentals / fees for condominiums, hotel rooms, rounds of golf, books or Trump-licensed products (e.g., ties, mattresses, wine, etc.) that could have produced income attributable to: Russian sources (such income would not have been separately identified as “Russian” in your books and records and therefore not separately reflected on your tax returns). With respect to this last exception, the amounts are immaterial.

Translation: We are listing a few innocuous items to sound convincing. We decided what is material and immaterial. For example, the sale of a condo to a Russian for a few million dollars might seem immaterial to us in this context. We also can’t look beyond any shell companies that, while not Russian, might be controlled by Russians. And we haven’t said anything about income from other former Soviet states, only income from Russia.

Regards,.

Sheri A. Dillon.

William F. Nelson

What to make of this

Here’s the problem: Trump’s penchant for making up facts and changing his story means that this letter is a Rorschach test. You see in it what you want to see.

If you believe in Trump and feel the Russian investigation is a witch hunt — that, as he told NBC’s Lester Holt “This Russia thing with Trump and Russia is a made-up story,” — then this letter reinforces your belief that there’s nothing there.

If you believe Trump is crooked and that his connections with Russia are real, this letter has plenty of loopholes that could conceal those connections.

Since Trump has neither divested his assets nor put them in a blind trust, there is no way to be certain about his personal financial interests here.

In 2013 Trump said, “Well, I’ve done a lot of business with the Russians. They’re tough.” In 2008, Donald Trump Jr said, “Russians make up a pretty disproportionate cross-section of a lot of our assets.” Are these statements inconsistent with the letter, or do they fit within the loopholes?

It’s impossible to know. Because when it comes to this administration, truth slips through your fingers. And you always have to watch for what isn’t said, especially by lawyers.

See also the following sources:

Andy Kroll annotated version of the letter on Mother Jones.

Josh Marshall in TPM on what the letter doesn’t cover.

Robert Schlesinger in US News on why he is skeptical.

Matthew Yglesias in Vox on what Trump hasn’t said about possible Russian investors.