The crash: stocks and Bitcoin

Nearly every financial asset is dropping in value. But they are not all the same.

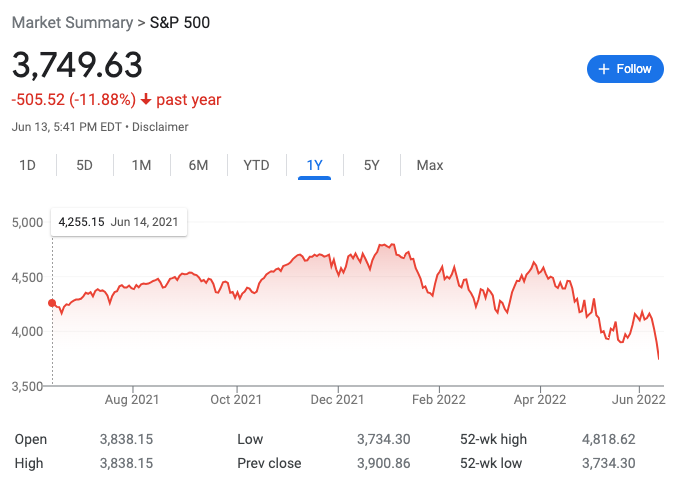

Here is a chart of the S&P 500 for the last 12 months. Any other index of stocks has a similar chart.

A year ago, the S&P 500 index was at 4255. As I write this it is at 3750. That is a decrease of 12%.

If you invest in stocks and only expect them to go up, you are a fool. But over decades they generally do go up.

Where is this index going? No one knows, of course. But the value of the index is based on the value of stocks, which comes from expectations for the value of the stocks. That seems circular, but there is a foundation under it. That expectation comes from the accumulation of investors’ predictions of profit.

The companies in the index have assets. They have customers. They have profits. The value of those assets, customers, and profits will change based on the broader economy. The value of the index today comes from the accumulation of people’s assessment of where those profits are going. When investors expect a recession — which is likely, given the actions the Fed is taking to tame inflation — the value goes down. But unless you expect a deep and continuing recession, the value will come back at some point: the point at which the expectation for the future stream of profits starts to rise again.

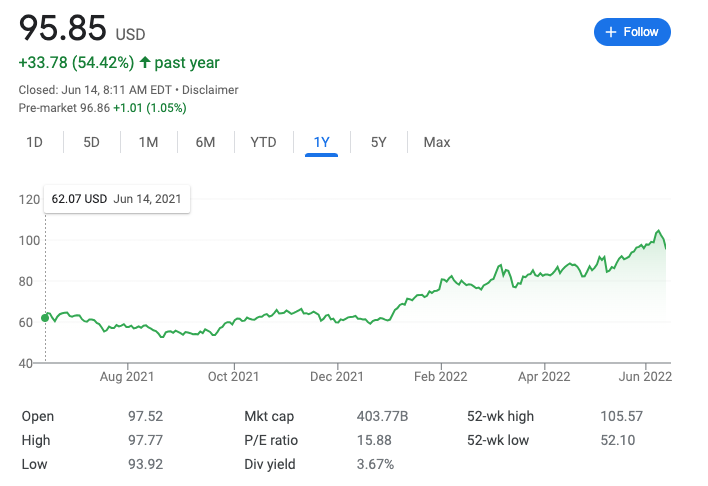

Here is the same chart for Exxon Mobil:

The value of Exxon shares has increased from 62 to 96 in the last year, an increase of 54%. This is because the company’s profits are up significantly in this period of high inflation for fuel. If the government passes a windfall profits tax, the price will go down. You can measure these things. You can analyze them. While predictions are subject to uncertainty, they do at least follow a rational pattern based on underlying trends. Figuring out that pattern is what analysts do.

What about Bitcoin?

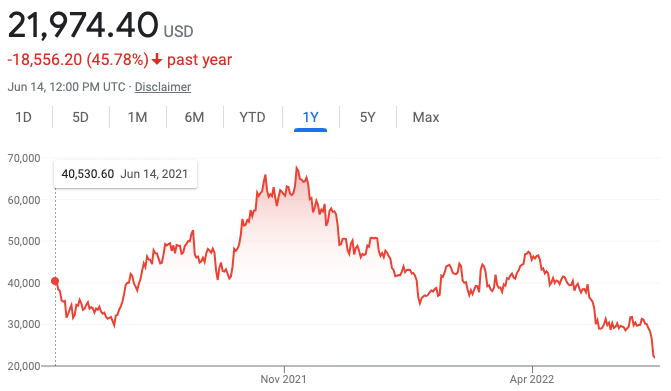

Here is the same chart for the price of Bitcoin:

Bitcoin has dropped from $40,531 to $21,974 in the last 12 months. (Also, somewhere in there, it was above $67,000). That is a 46% drop in the last 12 months.

Why did it go down? Because people who owned Bitcoin decided it wasn’t worth as much. Because the price people were willing to pay went down.

If these things seem circular, they are. Unlike Exxon or the S&P 500, there is no underlying value here. There is no stream of profits to assess. There is no asset. There is simply a supply of Bitcoin and demand for it. The supply is limited by the cost to mine new Bitcoins. The demand is based on nothing more than the shared hallucination of Bitcoin investors.

Any “analyst” of Bitcoin’s price has no way to assess where it is going, since it’s based solely on sentiment. That is, unless you have some way of assessing how much Bitcoin blackmailers and drug dealers need to to run their illicit businesses .

If you are an investor, that should scare you.

There is no bottom. There are only expectations of how many bigger fools there are.

Gambling is fun, but you should expect to lose your money.

Bitcoin is fun, too.

Caveat emptor.

(Note: All charts from Google Finance.)

The Bitcoin market reminds me of the tulip craze in 16th-century Holland. It’s speculation for greed’s sake, not for the sake of producing anything of real social or material value. At least tulips are something to look at and are good for the environment, unlike Bitcoin.

I heard WEB say he would not pay $25 for the lot of Bitcoin. I am willing to pay $30, because I’m younger and can afford the gamble.

I recently read The Psychology of Money: Timeless lessons on wealth, greed, and happiness. It’s interesting to examine others’ viewpoints on risk, inflation, and security. TL;DR: There’s a difference between reasonable and rational.

At its peak, the crypto market was worth $3T; today it’s worth $900B. That’s a staggering and avoidable loss.

Investment and speculation are not the same thing and I am grateful to you for reminding the public.

In order not to get upset at times like this, when cryptocurrencies are down 50 percent or more, you need to study the cycles that are present in the market (not just crypto). Bitcoin can’t go up all the time because the higher the price, the less people want to buy it, because they might think that the asset is already overvalued and they are not willing to pay that much for it. At times when I don’t know how to trade, I prefer to use trading bots. Algorithmic trading has now reached the next level and has really become an integral part of trading. I recommend to do some research, visit site and read reviews by trading experts. It will all help you save your deposit in the future.