Tesla CEO Elon Musk tells the truth (mostly) about layoffs

In a layoff, a company gets rid of people to boost profits. Everyone knows it; no one ever actually says it. Except Elon Musk.

Rather than using corporate layoff doublespeak like downsize, rightsize, and RIF (reduction in force), why not tell the truth? Take a look at what Musk said and how he said it. Tesla’s stock price took a 13% dive, but I don’t think his honesty was responsible. At least his staff knows what really happened.

Analyzing Musk’s email to staff

CNBC published the text of what Musk wrote to his employees. I wish we knew the subject line, which should be something like “To remain profitable, we have to lay some of you off.” Here’s the text of the email along with my analysis and suggestions for alternate language.

As we all experienced first-hand, last year was the most challenging in Tesla’s history. However, thanks to your efforts, 2018 was also the most successful year in Tesla’s history: we delivered almost as many cars as we did in all of 2017 in the last quarter alone and nearly as many cars last year as we did in all the prior years of Tesla’s existence combined! Model 3 also became the best-selling premium vehicle of 2018 in the US. This is truly remarkable and something that few thought possible just a short time ago.

Commentary: Like many bad-news emails, this one starts with good news. This is ineffective — people know the bad news is coming, and word spreads.

Alternate language: Tesla did two incredibly difficult things last year: We ramped up our production to record levels and we became profitable for two quarters in a row. The Tesla Model 3 is now the bestselling premium car in the US. Now we need to make some changes to maintain our position and our profitability.

Looking ahead at our mission of accelerating the advent of sustainable transport and energy, which is important for all life on Earth, we face an extremely difficult challenge: making our cars, batteries and solar products cost-competitive with fossil fuels. While we have made great progress, our products are still too expensive for most people. Tesla has only been producing cars for about a decade and we’re up against massive, entrenched competitors. The net effect is that Tesla must work much harder than other manufacturers to survive while building affordable, sustainable products.

Commentary: Face it: This is a series of excuses. We do what we do because it will preserve life on earth. Our competitors are big and established. Just say what you mean.

Alternate language: While we have made great progress, our products are still too expensive for most people. Our competitors are making gas-powered products and they’re cheaper than ours. We can’t survive unless we can compete in this marketplace.

In Q3 last year, we were able to make a 4% profit. While small by most standards, I would still consider this our first meaningful profit in the 15 years since we created Tesla. However, that was in part the result of preferentially selling higher priced Model 3 variants in North America. In Q4, preliminary, unaudited results indicate that we again made a GAAP profit, but less than Q3. This quarter, as with Q3, shipment of higher priced Model 3 variants (this time to Europe and Asia) will hopefully allow us, with great difficulty, effort and some luck, to target a tiny profit.

However, starting around May, we will need to deliver at least the mid-range Model 3 variant in all markets, as we need to reach more customers who can afford our vehicles. Moreover, we need to continue making progress towards lower priced variants of Model 3. Right now, our most affordable offering is the mid-range (264 mile) Model 3 with premium sound and interior at $44k. The need for a lower priced variants of Model 3 becomes even greater on July 1, when the US tax credit again drops in half, making our car $1,875 more expensive, and again at the end of the year when it goes away entirely.

Commentary: Now we get to the truth: this is about profit. You can see Musk laying out the narrative: the Q3 profit came from selling higher-priced cars, but the volume is coming from the lower-priced cars (one of which I purchased in December). Tesla has already announced a price cut to address the reduction in the US subsidy.

Alternate text: We made a 4% profit in Q3 of last year, and will announce a profitable Q4 as well. But those profits came largely from selling higher-priced variants of the Tesla Model 3 in the US and then in Europe and Asia. Now the volume is ramping up as we produce the lower-priced mid-range Tesla Model 3, and we need to keep that price low even in the face of the reduced subsidies in the US.

Sorry for all these numbers, but I want to make sure that you know all the facts and figures and understand that the road ahead is very difficult. This is not new for us – we have always faced significant challenges – but it is the reality we face. There are many companies that can offer a better work-life balance, because they are larger and more mature or in industries that are not so voraciously competitive. Attempting to build affordable clean energy products at scale necessarily requires extreme effort and relentless creativity, but succeeding in our mission is essential to ensure that the future is good, so we must do everything we can to advance the cause.

Commentary: This is just rambling and excuses. It serves no purpose but to make Musk and his senior management feel better.

As a result of the above, we unfortunately have no choice but to reduce full-time employee headcount by approximately 7% (we grew by 30% last year, which is more than we can support) and retain only the most critical temps and contractors. Tesla will need to make these cuts while increasing the Model 3 production rate and making many manufacturing engineering improvements in the coming months. Higher volume and manufacturing design improvements are crucial for Tesla to achieve the economies of scale required to manufacture the standard range (220 mile), standard interior Model 3 at $35k and still be a viable company. There isn’t any other way.

Commentary: Finally, Musk gets to the point. This could be more direct. What Musk has not said is why profit is crucial: Tesla’s financial situation requires it.

Alternate text: For Tesla to remain financially viable, we must continue to make profits. To do this, we must also increase the production rate for the Tesla Model 3, improve manufacturing efficiency, and manufacture a lower-cost model of the Tesla Model 3. The only way to maintain profitability is to lay off 7% of our staff. We added 30% to hour headcount last year, and we can’t continue to pay that level of salaries and maintain profits.

To those departing, thank you for everything you have done to advance our mission. I am deeply grateful for your contributions to Tesla. We would not be where we are today without you.

For those remaining, although there are many challenges ahead, I believe we have the most exciting product roadmap of any consumer product company in the world. Full self-driving, Model Y, Semi, Truck and Roadster on the vehicle side and Powerwall/pack and Solar Roof on the energy side are only the start.

I am honored to work alongside you.

Thanks for everything,

Elon

Commentary: Typical language for a layoff, but necessary nonetheless. I have no alternate text: this language is fine.

A few observations about this email and layoffs in general

Musk’s email stands out because it not only talks about how sorry the company is to let people go, which is typical, but actually lays out the case for where the profit comes from and what the company has to do. This is unusually transparent and straightforward; in fact, I’ve never seen it in an email to staff during a layoff.

Having entered this uncharted territory, Musk’s communication could be better. This is still written in a stream of consciousness form rather than putting the most important information first. It omits the reason why profitability is crucial to Tesla: its financial situation and bond holders mean that the company must generate cash and can borrow no further.

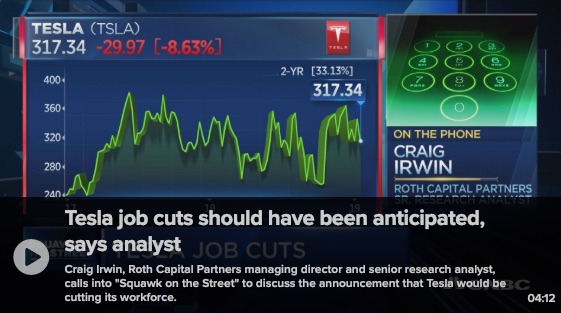

One other observation. Anyone watching Tesla’s progress this year could see this coming. Tesla’s future depended on maintaining profits, increasing manufacturing volume, and lowering the cost of the Model 3. The end of the subsidies was entirely predictable. Financial analysts had predicted these cuts.

Does this make life easier for the employees losing their jobs? No. But as an employee, part of your responsibility is to observe the financial situation of the company, especially a company like Tesla with a future that’s balanced on a knife edge. If you assumed you would have job security at Tesla, you made an important error.

People are sometimes loyal to companies. Companies, especially publicly traded companies, are almost never loyal to people. This is another thing we never say out loud, but the history of American business shows it to be true.

A nice analysis that prodded me to a response. I would like to have seen you explore the context more.

Clearly there are three audiences for this e-mail and everyone should recognize that. There are the people being laid off (sucks to be you man) and then there is the general public most specifically stockholders. Then of course there is the SEC.

For the internal audience: Whether the e-mail is too wordy or meanders around the point has everything to do with how Musk communicates to them the rest of the time. There are bosses that just bark out orders and then those who just love talking about the business and doing back and forth, and if the CEO is an engineer (yes, Musk) they will talk with you all day over every technical point. They consider market analysis and margins technical. I read this e-mail and I see that type of CEO.

Had Musk not been too wordy and expository it would have projected low confidence or even intense worry.

For the other audiences you have to remember that Musk is operating in a media environment that includes some quarters intensely hostile to him and to Tesla. For various reasons there are plenty of “journalists” around who seem to have made it their lives’ mission to write a shockingly devastating article about Tesla and its CEO. Musk in the past has had to call out publications (not minor ones either) who deliberately sabotaged their own road tests of the Model S so they could write a negative review of it. To this day I run into people who believe Teslas routinely burn up in “Tesla fires” and the wheels fall off. Then there are the stories about and from the “shorts” who have shorted Tesla stock hugely and billions of dollars have been lost because the stock kept going up and up. (Most of those I think have been forced to book those losses because of risk management rules but the resentment likely remains.) Clearly those people have big incentive to spread a very negative story about Tesla. And they do.

So when I read this e-mail I see a CEO keeping all that in mind. It might look rambling but he hit most of the major bromides that would be brought up endlessly in countless message boards. He had to get ahead of those somehow. You look in those queues and you will see derisiveness normally reserved for someone like Hillary Clinton directed towards Musk. Many of them are now abundantly triumphant over the news of this lay-off and are interpreting it as proving once and for all how delusional or fraudulent Musk is.

Finally, also remember that Musk and Tesla has been slapped with whopping fines over a pretty defensible comment Musk made about potential buyers for Tesla. I don’t want to get into that but it is beyond imagination that Musk at this point would write a letter like this without passing it by legal counsel and CFO review. So at the end of the day that input might have contributed the flaws you pointed out.

Having said all that I very much enjoyed your posting.

Elon pumped up Tesla with help in the form of hype from Internet News (who were also investors) for a private sale that would have made him billions. Unfortunately for Elon, the dump didn’t work. He has continued his pump and dump narritive hoping that it would pay out before Tesla, SpaceX, and the Boring Company became a falling house of cards. Unfortunately, his charlatan ways are becoming obvious and finding US funding ($5B) and Panasonic funding is drying up. He currently needs another sucker to invest.