Navient COVID-19 email: not just vacuous, but deceptive

Are you helping your customers right now, or screwing them?

Like so many other companies, Navient, a student loan servicer, sent a vacuous, unhelpful email about the COVID-19 pandemic. You could easily ignore it, or just give it a cursory read.

But because of changes passed by Congress, many borrowers don’t have to pay anything for six months. Navient decided to hide this “notice” under an innocuous link that most of its customers will ignore. The result will fool many borrowers into making payments they don’t have to make.

Here’s the email that Laura, one of my readers, received from Navient:

Subject: Coronavirus update for your student loans

Laura, here’s more info about help available on your student loans.

During this uncertain time, Navient is committed to keeping you informed about what is available to help you manage your student loans. A couple of weeks ago we introduced you to a dedicated COVID-19 page. To help answer questions about available options and recent announcements, we’ve added a new ‘Frequently Asked Questions’ section this past week.

Please visit Navient.com/COVID-19 for more information. We encourage you to check back often, as we are committed to serve you during this unprecedented time and will continue to update this page to keep you informed.

Like most of the country, the majority of our representatives are now working from home offices. We ask for your understanding if you hear a dog barking or other background sounds. You can always access your account 24/7 on our website or our automated voice response system. We appreciate your patience as we all get adjusted to this ‘new normal’.

If you’ve been impacted by the coronavirus and are having difficulty making payments, we’re here to help you explore your long-term options to reduce or postpone your payments. If you need immediate relief due to the pandemic, you can request a coronavirus national emergency forbearance for up to 90 days. Give us a call at 888-272-5543 – we’re here for you.Thank you and please be safe.

This checks all the boxes on vacuous emails during a viral pandemic:

- Generic greeting: “During this uncertain time . . . “

- Announcement of a seemingly minimal level of help for customers: “We introduced a new page and an FAQ.”

- Putting the onus on the customer: “We encourage you to check back often . . .” (Sure, what else do you have to do during an emergency but frequent checks on your student loan page?)

- Excuses in advance for poor service: “We ask for your understanding . . . ” (I’m a lot more inclined to be tolerant of organizations that treated me well before the pandemic.)

- Buried lede: “You can request a coronavirus national emergency forbearance for up to 90 days.” (How busy do you think those phone lines are right now?)

The worst part of this is what’s not in this email

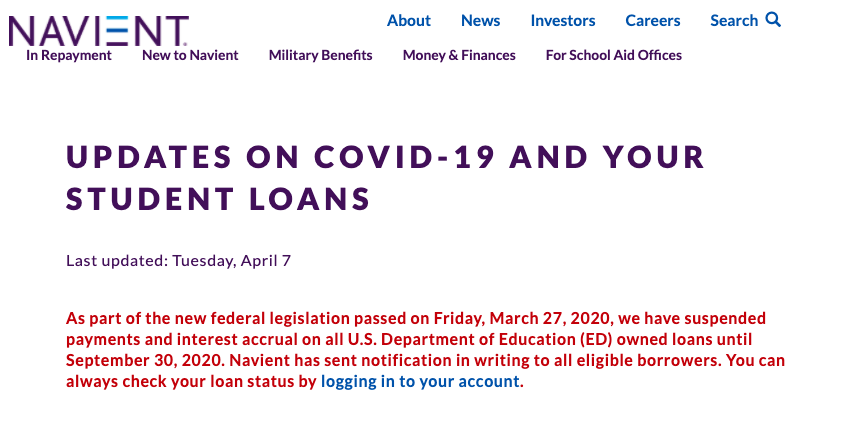

Laura just happened to click on that first link, the dedicated COVID-19 page. Most people wouldn’t — what resources could a student loan servicer have about a pandemic? But here’s what you see if you click on that link:

So if you have a Department of Education-owned loan, there’s no need to pay at all until September, and no need to call, either. This doesn’t apply to all loans, but it clearly impacts many of them. If Navient has “sent notification in writing to all eligible borrowers,” why didn’t it include that notification in the email? (The email was sent on April 7, the same day that the Web page was updated, and 11 days after the new legislation was passed.)

Hanlon’s Razor states that you should never attribute to malice that which is adequately explained by incompetence. But now we have to choose an explanation.

Why did Navient send an email suggesting you should call a probably wildly overloaded service number to get forbearance on your loan, when its own website explains that you may not have to pay for six months? And why did it include that notice under a link that most people wouldn’t think to click?

Was it because its email communications group was incompetent?

Was it because explaining the different situation depending on what kind of loan you have was too complicated to put in an email, but not too complicated to put on a Web page?

Or was it because they hoped a bunch of people wouldn’t realize what was happening and would make payments they didn’t need to?

What do you think?

Totally inclined to agree. Just got this email, saw that it said nothing and filed it away. I did NOT check the link. Now, I will go back and figure out if I have to pay or not. I could def use that loan payment amount right now!

What bullshit, I’m sorry to the vulnerable people like Laura right now who can’t get straightforward information they need. “During this time” my ass — and please, let’s not involve dogs barking in the background of phone calls! So tired of the most vacuous emails from the most random people; I’m getting emails from hairdressers in other cities I haven’t heard from in years, from vets I went to once ages ago, they’re wasting everyone’s time and mine to be opportunists and say absolutely nothing. Anyone sending me one of these bullshit messages is on my radar for services to trim from my budget, if they aren’t already trimmed (in which case I make sure to mark messages as spam). Thank you for exposing this bullshit.

Another thought: Emails like this are dangerously deceptive and I’d imagine could be “business malpractice” or something. Legal action should be taken against Navient for blatantly withholding important information from customers — is anyone looking into legal action? This is more than bullshit, it’s not right.

Thank you for highlighting this type of hidden program. I’m worried that even the term “forbearance” isn’t clearly understood by those wishing to take advantage of such assistance, and can be vague in such “helpful” offers of aid. Often, it means that the months unpaid all become due together at the same time at the end of the forbearance period. So say you owe $1000 monthly, and your payments are zero for six months, then you owe $6000! I think a lot of people assume the months are just skipped over and the regular payment resumes after a break, then they receive a shock when all the skipped payments come due at once. I’m sure there are many options between what is offered, but those details need to be set and understood.clearly. Is this type of language something you can cover in a future article? Thanks for sharing all your knowledge on clarifying writing!

I applied the first week and was immediately put on the program (no payment due till Sept). This week my credit score dropped. When I investigated it was because Navient charged me interest and my balance went up. When I spoke with them they told me that my FFELP loans qualify for the program for suspended payments but not for 0% interest. In other words, if I take the help, I’ll be $1000 more in debt and it will compound over time, making my 27 year payment plan stretch into…. 28? 29? Years.This help isn’t really helping.

All over my account it indicated 0% interest, it said no payment due. Yet my autopayment was taken as usual and when I logged into my account, it showed they also charged interest. I emailed to ask why a federal loan was still charging me and charging interest, the advised me since I “consolidated” my loan, I am not eligible for forbearance! It is still a federal loan, with federal interest rates, but apparently consolidating them into one payment makes them unprotected. But why show 0% interest, why show nothing due. VERY DECEPTIVE!

Hi, I thought my loans were not due until September, due to the Covid 19 forbearance? I am getting billed for June and July?

I have the FFELP status. It is Sunday, so I can’t call anyone? I thought I could ride a bit of time and not spend my loan money on Navient payments, and spend some money on life payments.

Why would I be ‘given’ forbearance until September, and July wham me with two late bills?

Also, 20 year teacher… Didn’t get my loans cancelled. I consolidated years ago. They are still FEDERAL LOANS! Sallie Mae owned me, then the loans went to Navient.

What is going on with lawsuits? Thanks for your reply!

I called Navient and they said that I cant get 0% interest? Also, interest would still continue to accrue for 90-days if I did a forbearance. What gives? On the Navient site, it says I have ‘type: FFELP’, and its a mix of Stafford subsidized and unsubsidized loans. This is always confusing for me. Please help.